Essential Information

Airport

Bilbao Airport (BIO)

Weather in May

Season: Spring

Min. Temperature: 11℃

Max. Temperature: 18℃

Avg. Temperature: 14℃

For the latest weather information, visit:

Bilbao Weather Forecasts

Time Zone in May

Bilbao: UTC +2:00hrs

Singapore: 6:00 PM

Bilbao: 12:00 PM

*Singapore is 6 hours ahead of Bilbao.

Sunrise/Sunset Time

Sunrise: 6:58AM

Sunset: 9:20PM

Currency

Euro (€)

1 EUR = 1.42 SGD*

*Rate is last updated as of 18 Feb 2025.

VAT

Standard Rate: 21 %

Language

Main languages in Bilbao are Spanish and Basque (Euskera), but most hotel staff, and workers in popular tourist spots can speak English.

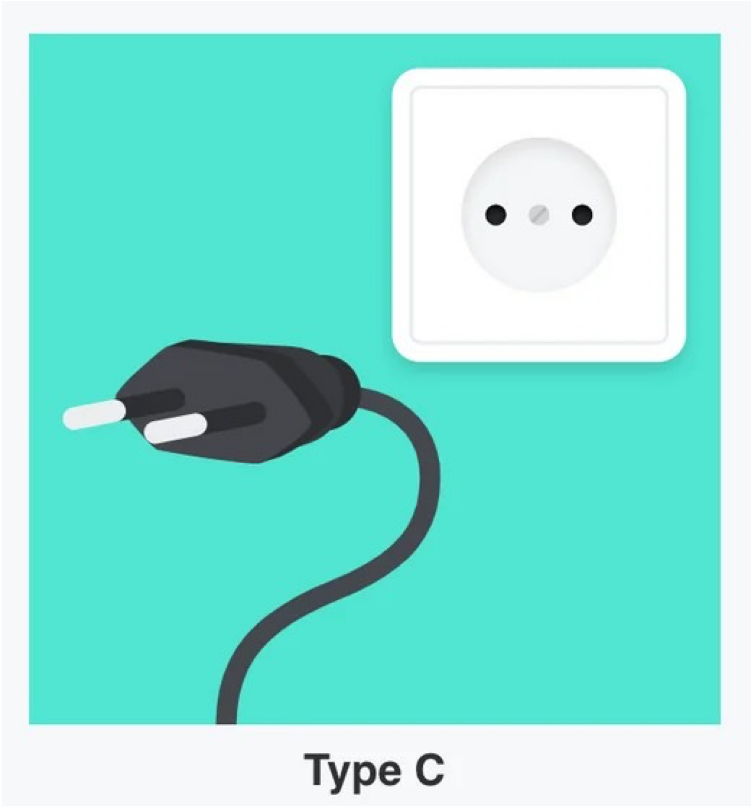

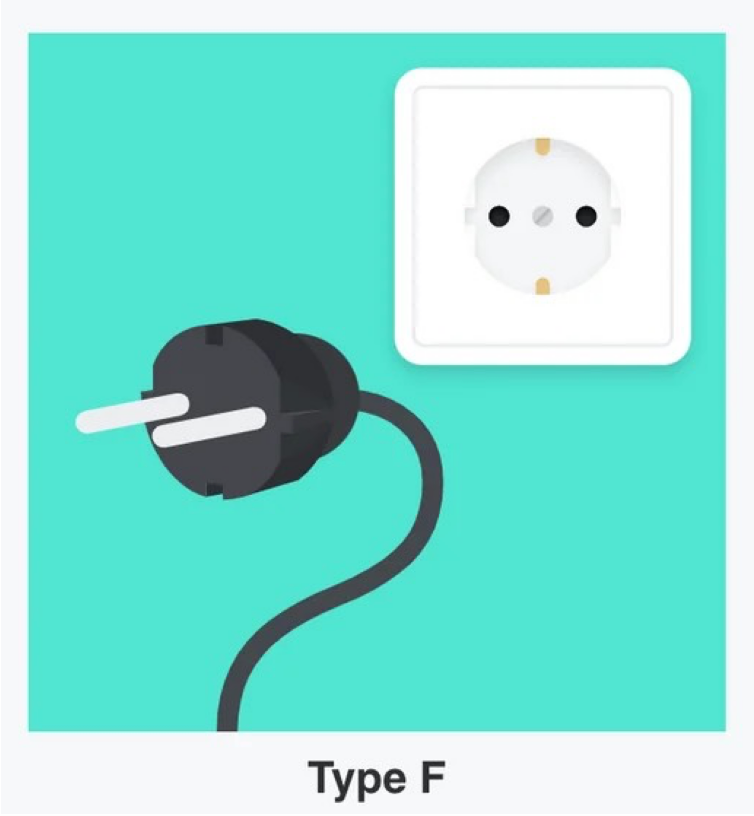

Electricity

- Voltage: 120 Volts

- Frequency: 60Hz

- Plug Type: Type C and F

Do bring along your voltage converter / travel adapter.

Water Potability

Tap water in Bilbao is safe to drink.

Dialling Code

Country Code: +34

Useful Contact Numbers

Police: 112

Ambulance Service: 112

Passport / Visa

Passport

Please ensure your passport has at least 6 months’ validity from your date of return from Bilbao, Spain

Visa Requirements

Citizens from the following countries are exempted from Visa requirements for entry into Bilbao, Spain:

- Singapore

- Malaysia

- Hong Kong

Citizens of the following countries will be required to apply for Schengen Visa for entry into Bilbao, Spain:

- China

- Indonesia

- India

- Thailand

- Vietnam

VAT Refund

The standard VAT rate in Bilbao is 21%.

To obtain a refund of VAT charges, which must be documented on invoices, the purchaser must request for the electronic DIVA Tax-Free form or electronic refund document (ERD) from the seller, with precise details of the purchase, which the seller will provide in a stamped envelope. This document must be stamped by the purchaser at the airport prior to departure from the EU with the goods for which a VAT refund is being claimed.

In order to obtain a DIVA Tax Free stamp, it is essential to bring:

- Passport

- Purchase invoices and the DIVA form.

- The goods for which the refund is requested.

- Boarding pass or travel ticket.

Once stamped, either electronically or manually, the purchaser will put the DIVA Tax Free form in the envelope provided by the seller for this purpose and deposit it in the airport post box, also located in the departure hall. Upon receipt of the document, the seller shall refund the full amount of the fee charged within fifteen days by cheque, bank transfer, credit card or other accredited means of reimbursement.

VAT Refund Procedure

1. Prepare Your Documents

Make sure you have all the necessary documents ready:

- Tax-Free Forms: These are issued by the stores where you made your purchases. Ensure they are completed correctly, with your passport details.

- Receipts/Invoices: Keep the original receipts for all the purchases you want to claim.

- Passport: You’ll need to present your passport as proof that you are a non-EU resident.

- Goods: The items you purchased must be unused and still in their original packaging for customs inspection.

2. Arrive at Bilbao Airport Early

To allow time for the VAT refund process, arrive at the airport at least 2 to 3 hours before your flight, especially if you need to check your luggage.

3. Validate Your Tax-Free Forms at Customs

Before checking in your luggage, visit the Customs Office at the airport (located in the departures area).

- Present Your Documents: Show your tax-free forms, receipts, passport, boarding pass, and the goods you’re exporting.

- Customs Stamp: The customs officer will review your documents and the goods, and if everything is in order, they will stamp your tax-free forms. This stamp is essential for processing your refund.

4. Use the DIVA Kiosk (Electronic Validation)

Bilbao Airport has DIVA Kiosks for electronic validation of tax-free forms.

- If your forms are eligible for DIVA (which many shops in Spain use now), you can simply scan your DIVA form and passport at the kiosk, and the validation is done electronically, without needing a customs stamp.

- Location of DIVA Kiosks: The DIVA kiosks are located near the customs area.

5. Claim Your VAT Refund

Once your forms are stamped or validated at the DIVA kiosk, proceed to the VAT Refund Desk in the airport. Look for refund companies like Global Blue, Planet, or Innova Taxfree.

- Refund Options:

- Cash Refund: You can receive your refund in cash (usually in euros or other currencies).

- Credit Card or Bank Transfer: You can also request the refund to be sent to your credit card or bank account, but this may take a few weeks to process.

Embassy Information

Singapore

Honorary Consulate-General of the Republic of Singapore in Madrid

Avda de Bruselas, 28, 28108 Alcobendas, Madrid, Spain

Mon – Fri (9:00AM – 2:00PM)

+34-916-629-373 – Website

China

Embassy of the People’s Republic of China

Calle Arturo Soria 111-113, 28043 Madrid Spain

Mon – Fri (9:00AM – 5:00PM)

+34 915 194 242 – Website

Malaysia

Embassy of Malaysia, Madrid

Avenida de los Madroños, 63 bis, Madrid

Mon – Fri (9:00AM – 5:00PM)

+34 91 555 0684 – Website

Indonesia

Embassy of the Republic of Indonesia, Madrid

Calle Agastia, 65, 28043 Madrid (Madrid Region) Spain

+34 914 130 294 – Website

India

Embassy of India, Madrid

Av. de Pío XII, 30, Chamartín, 28016 Madrid, España

Mon – Fri (9:00AM – 1:00PM, 1:30PM – 5:30PM)

+34 91 309 88 82 – Website

Thailand

Royal Thai Embassy, Madrid, Spain

Calle Joaquin Costa, 29, 28002 Madrid

Mon – Fri (9:00AM – 5:00PM)

+34 91 563 2903 – Website